More About This Episode

The Smarter Building Materials Marketing podcast helps industry professionals find better ways to grow leads, sales and outperform the competition. It’s designed to give insights on how to create a results-driven digital marketing strategy for companies of any size.

Jason Hartman, Founder and CEO of The Hartman Media Company, has a unique perspective on what's happening in today’s investment markets. He spends most of his time helping investors buy properties and teaching financial literacy to others, so we talked with him to better understand the real estate market, and how it impacts the building materials industry today.

Empowered Investing: Understanding the Housing Market

“So just a really brief background is that I used to be in traditional real estate,” explains Jason. He started out selling properties, and then moved into the business of helping investors acquire properties nationwide and building their portfolios.

“And so really for the last 18 years, I've been helping investors buy properties nationwide, and I've been teaching them how to invest, how to evaluate markets, the economics of real estate and the general economy,” explains Jason. He’s brought that kind of education to the digital landscape and now runs a few real estate and media businesses, including the Empowered Investor podcast and YouTube channel. Jason works with all types of investors, but also provides financial literacy education to young adults through his nonprofit program.

Jason talks with a lot of investors, new and experienced, on a daily basis. “And the problem I find, and many people are concerned,” explains Jason, “they might think that housing, for example, is overvalued because the price in dollars has increased quite dramatically, right?” But Jason suggests that we’re using the wrong kind of measuring stick to determine value.

He says a more accurate method of understanding the housing situation is “to use multiple measuring sticks to compare the price of housing to multiple things, rather than just one thing.”

Jason points out that many folks are getting wrapped up in the price of homes today, but failing to ask the right question about the market. “And that question is, compared to what? And I think this is literally, quite possibly the most important question in life, not just in the topic of our discussion today, because think about it. Everything we do in life is a comparison,” says Jason. “When we're picking a business partner, friends, you compare people to other people to make decisions, right? And that's what people do in any marketplace.”

Jason has noticed a specific kind of trend in the marketplace, “And what I've noticed is that money flows to the best value most of the time, not always,” he explains. “People will be hypnotized and they'll have crazes and they'll buy tulips at high prices and all sorts of other things, and maybe Bitcoin, I don't know. And sometimes real estate for sure. But eventually, the market will figure it out.”

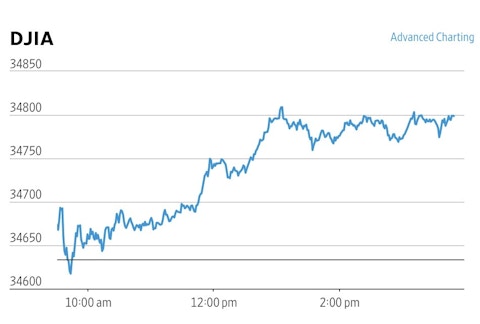

One market that we’re still trying to figure out is lumber: Prices for lumber dropped significantly at the end of June, a reprieve after months of increasing numbers. Does that mean we’ll see busier worksites now that lumber is available?

Well, it’s not about just one commodity, or one measuring stick, as Jason suggested. We need to look at things a little more holistically.

Commodities, Construction & COVID

So will housing continue to perform better in comparison to other commodities in the market? The number of new homes in demand has the construction industry already backed up. That kind of demand isn’t fun for anyone.

“It's very difficult to operate in this type of market because inventory is so low,” says Jason. “It's not a pleasant market in which to operate, but people are making money.”

But there are a couple of key factors at play here. Because in construction, there’s another supply issue going on (among other things):

- If you’re a manufacturer, this isn’t news, but the demand for products is higher than ever. So high, in fact, that manufacturers can’t sell products — there just isn’t any product to sell.

- To compound things further, there’s still a labor shortage plaguing the construction industry. And that’s a trend across all industries. “It's a common complaint. Restaurants, beauty parlors and factories all have plenty of customers right now but not enough workers to meet the demand,” according to Sharon Pruitt-Young for NPR. “The Labor Department said Friday that U.S. employers added 850,000 jobs in June, including 194,000 in bars and restaurants. But overall payroll employment is still 6.8 million below its pre-pandemic level.”

- Even when supply starts to increase, we could see a rise in artificial scarcity. In markets like lumber, the pandemic has resulted in giving these dealers higher margins. While lumber prices dropped after all-time highs, there’s no returning to “normal” pricing.

How will the market adjust? Probably not how anyone in the industry would predict. For real estate investors, this means buying up what they can, while they’re able to. “So we certainly know that there are a lot of institutional investors in the residential housing market nowadays, and the small investors are trying to buy everything they can as well,” explains Jason.

“There's just a ton of optimism out there,” he says.

How To Know When the Bubble Will Burst

Jason struggles to put a date on when we’ll see inflation in the housing market finally shift.

“The reason I can't answer that question, and nobody can, is because they don't know the prices of other things at that time. So we could sit here and say, okay, look, let's assume housing keeps appreciating at 10% every year, right?” he explains. “But we don't know what the price of rice and oil and orange juice and gold and Bitcoin will be. So all of these things are constantly ebbing and flowing together.”

What can be guaranteed is that builders will be busy this year with construction starts. People have been stuck inside and want a change of scenery or a larger space. Homes will be in demand for the foreseeable future.

Jason also points out that a mortgage payment today is actually less than it was in decades past when you account for inflation. “Twenty-one years ago, to pay your mortgage, you'd have to work 69 hours at the average wage,” explains Jason. “Today, you only have to work 46 hours to pay the mortgage. So priced in hours in your time, the only thing you can never get back, it's cheaper to have a house today.”

Human behavior will determine what happens with housing in the years ahead. After a global pandemic, the impact on consumer spending has been significant, and not everyone will want to put their money into a home. They might want to spend their money on entertainment or travel instead of a mortgage payment.

“And that's what's going to determine that,” Jason says.

Want Even More Insight?

Jason spends more time explaining what’s happening in real estate on his website and gives some insight into what’s happening in today’s economy.

Go deeper into the value of the dollar and how that impacts the construction industry today by listening to the full episode.

Then check out Jason’s YouTube channel or podcast.

Thoughts? Questions? We’d love to hear your opinion about this week’s episode at [email protected].