More About This Episode

The Smarter Building Materials Marketing podcast helps industry professionals find better ways to grow leads, sales and outperform the competition. It’s designed to give insights on how to create a results-driven digital marketing strategy for companies of any size.

Grant Farnsworth is the President of The Farnsworth Group. He talks with Beth and Zach about the 2024 to 2025 outlook on new single-family residential construction, as well as the upcoming Building Products Customer Workshop being held on October 11 and 12.

The 2024-2025 Outlook for New Single-Family Residential Construction

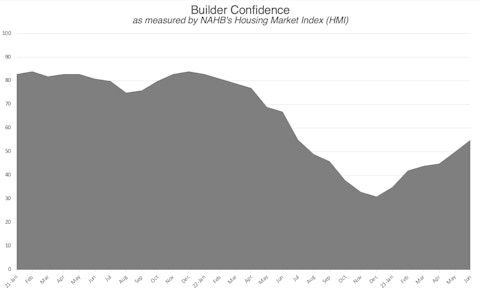

Grant posted an article on LinkedIn on the 2024-2025 outlook for new single-family residential construction that was surprising. The first graph in the article showed builder confidence tracked over the past 24 months. It was in decline until December of last year before it started improving.

Through conversations with clients, Grant believes this is because many in the building materials industry found this year wasn’t as bad as expected. “They're seeing a return particularly on the single-family side sooner than they expected,” says Grant.

Last fall, a recession was predicted and the thought was that home values were going to drop off a cliff like they did in 2008. “Six months into this year, there's enough data, activity, information, behaviors to support this isn't going to bottom out…I think there's more optimism than there is pessimism.”

Many people believe, Grant and team included, that rates are at the highest they’re going to be, and over the next year to two years, the consumer pricing index is going to decrease. Grant predicts modest but continued and sustained growth for the next several years.

However, one in three manufacturers isn’t hitting their sales numbers this year. “It's not a bottom-of-the-barrel year, it's not everything is terrible, but as you do in business, you know they've had three really successful years. And so when they projected out sales for this year, they projected additional growth because most people don't project shrinking,” says Beth.

To those manufacturers, Grant points out that even companies with good revenue are still down from where they were last year or the year before. “A lot of it is about inflation, so I don't know that I would get too in the dumps if you're not hitting some sales goals because we are still in a down cycle here.” If you’re concerned, talk to your clients. Ask them what they’re seeing in terms of request increases, closure rates and pipeline health. We are at the bottom of the trough right now, but we should be seeing an increase in the coming months to year.

Even on the commercial side, the sentiment Zach and Beth are hearing is that sales are not as bad as people thought they would be. As Beth puts it, “The vast, vast majority of conversations I had would be people who went from cautiously optimistic to almost apologetically optimistic of, ‘Hey, I know that it's not the same for everyone, but for the most part, our sales are really strong’ or ‘We've still got strong projections or our orders are coming in.’” Many of these comments are coming from manufacturers who felt a pinch during supply chain issues and are now able to open availability back up to meet demand.

The market is also seeing people stay in their homes for longer. This year, homes hit an average age of over 40 years old. Homes are getting older and people are moving less. Plus, many homeowners are using home equity to pay for renovations on their home. “So even without that lock-in effect of high rates, you've got some really strong fundamental powers behind the R&R market,” says Grant. People aren’t going to move and get rid of their 2.5 percent mortgage rate when rates are over 6 percent currently. That means larger projects down the road.

Research also shows that many in the Gen Z group want to own a home, so they’re currently saving to make big down payments. So while they’re not driving home buying and DIY activity right now, they will be in the future, which means manufacturers and builders need to keep an eye on them and what they want.

Consumer sentiment is on the rise as well. According to the University of Michigan’s consumer sentiment survey released July 21, 2023, consumer sentiment rose for the second month in a row, reaching its most favorable reading since September 2021. While the number is low — for consumers, builders and contractors — it is on the rise.

Building Products Customer Workshop

In October 2023, Venveo and The Farnsworth Group are hosting a workshop where we bring in your ideal audience and ask them about what’s happening in the market. For instance, last year we interviewed a panel with an architect, builder and remodeler.

The workshop is a great way for manufacturers to engage with their customer audience, something many manufacturers don’t do at all, let alone enough. “It pains me how much assumption our clients and manufacturers and marketers are required to work on and run on. And then the standards that they're held to without the knowledge base to be able to know and feel assured,” says Beth. “And that's why I think our workshop is so valuable is because there is Venveo and Farnsworth and leaders and thought leaders from our industry that speak. And I love hearing our speakers, and I learn something no matter who's sharing. We also try really hard to get out of the way and facilitate great conversations.”

Grant agrees. “We set the stage with some really good research that our teams do on the behaviors and attitudes and kind of what's happening today with both pros as well as some homeowners, but it's that conversation that happens afterward — that one is super unique.” It’s also a great way for manufacturers to learn from suppliers and from dealers and vice versa.

The work is designed to be an intimate setting that allows for interactions between different groups of people to learn from each other and come away with valuable insights that can change the course of their company.

Zach is most excited to hear from Steven Sweeney, CEO of Kodiak, who is going to talk about how the last 12 months have been and what he projects moving forward.

Beth is excited to see Danushka, the Assistant Vice President of Forecasting and Analysis at the NAHB. Danushka has great data that she presents in an exciting way that keeps viewers engaged. But she’s also excited for the “channel panel” where we bring in builders, architects, installers and others in the channel to speak candidly on what they are and are not getting from manufacturers.

Grant is excited to listen to Kermit Baker, an architect from AIA. He’s been a steward in the industry for years, and he’ll provide valuable insight on the multifamily commercial side of the market, including currency dynamics and fundamentals as well as expectations for the next few years.

Want Even More Insight?

If you want to experience great networking opportunities and listen to the best speakers, join us at the Building Products Customer Workshop on October 11 and 12. You can find the list of speakers and sign up at www.venveo.com/2024. We hope to see you there!

To learn more about the 2024-2025 industry outlook, listen to the entire episode here. You can reach out to Grant on LinkedIn.

Remember to like and subscribe to Smarter Building Materials Marketing wherever you get your podcasts.