More About This Episode

Smarter Building Materials Marketing podcast helps industry professionals find better ways to grow leads, sales and outperform the competition. It’s designed to give insights on how to create a results-driven digital marketing strategy for companies of any size.

We talk with building materials research expert Grant Farnsworth about the trends we’ve seen over the last two years, along with what manufacturers can do to sustain their business by planning ahead instead of just surviving in the now.

What’s Next in Building Materials?

Everyone’s talking: Prices are up in gas, groceries, lumber and other commodities. And while demand is hot in the construction market, prices are also way up.

This week’s episode was all about numbers, so we brought on one of our favorite guests, Grant Farnsworth, President of The Farnsworth Group, to chat about the data and insights we’re getting from the building materials market.

Before we made predictions about what’s next in the industry, we reflected on something Home Depot did about five years ago. “If you look at that Home Depot example … Lowe's wasn't far behind. We see a mad amount of consolidation in the lumber dealer space,” explains Grant.

These big brands invested billions in logistics and infrastructure, and when COVID hit, they were ready with solutions. “I mean, yes, it was around logistics and billions into new distribution centers and their online piece,” Grant says. “But I think it was all about meeting customer needs and expectations, and outthinking what's around the corner when it comes to those needs.”

Both retail giants were prepared for the surge of online shoppers who had been forced to research and purchase products at home when COVID first hit. Their websites featured more seamless purchasing experiences for buyers, whether they were a professional or a homeowner looking for product delivery or pickup.

The rest of us in the industry have responded to consumer demands for this kind of convenience — but it’s often in reactionary, knee-jerk ways to the crises we’ve encountered. To help manufacturers prepare, instead of react, to more change, we took a look at how a few of today’s building materials brands have adapted.

Ideas for Outlasting Competition

You might not be Home Depot or Lowe’s, but manufacturers can still take advantage of the opportunities that come with a rapidly changing market.

“A lot of manufacturers we're talking with — collectively, I think, for the last couple years — have almost been in survival mode. Just trying to keep up,” says Grant. It’s going to be necessary for building materials brands to have more foresight around not just their products, but how they can support their customers and stand out from the competition.

The key is focusing on three areas of business: Operations, Sales and Labor.

Operations

Today’s contractors and builders are busy, so when manufacturers can make their customers’ projects more efficient, that’s a big bonus. “If you look at some of our research, over half of the contractors that we surveyed are booked out at least a week or a month or more,” says Grant.

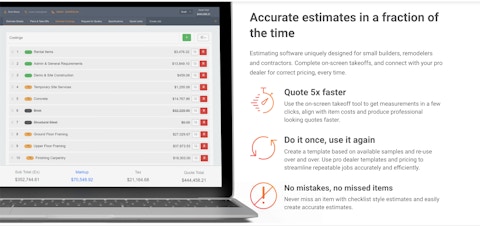

Today’s manufacturers can streamline their customer’s projects with technology and other tools. Planning tools and estimators can help customers price and prepare for their projects, and brands like Buildxact offer ideas for manufacturers who want to support their customers.

“I was talking with the folks at Buildxact and what they're bringing to the market to allow home builders a mad amount of efficiency. It's going beyond just takeoffs. It's talking about availability. It's updated price sheets that are current within the week,” says Grant, “all of these things that are helping me manage my business.”

“I think this is why we saw a lot of growth in online behaviors over the last 24 months,” says Grant. “I don't have to go drive 30 miles to go see what's in stock and place an order and have it delivered. If I'm working with someone that's worth their salt, I can just hop online. I can use an app, whatever the case may be, get it done right then and there and just save myself an hour and a half of driving around, trying to locate something and get it back to the job site.”

Sales

How can you support clients in their own sales process? Sales platforms like Roofr give roofing contractors a way to estimate projects and deliver proposals to their customers, all through one online platform.

Building materials brands have similar opportunities to help customers win projects and reduce friction in their sales process. “So [it’s a] really, really good opportunity, if you're a manufacturer out there, if you haven't started having some really in-depth conversations about where you can help facilitate that sales process for the contractor, for the homeowner,” says Grant.

Product visualizers and installation videos are a great way to support your customer’s sales process, along with solid customer service and a strong online presence.

Be sure to check out the top 5 types of content and information manufacturers should have on their website.

Labor

“So we've all known well before COVID that there's been a labor issue. We have a high rate exiting the trades and a much lower rate entering the trades,” says Grant. So what’s the biggest thing manufacturers can do to help the ever-present issue of labor in the building industry?

Change the perception of those jobs. Brands like Techo-Bloc have built programs to help train and welcome people into the landscape design industry, for example.

“I think there are two sides of the coin when we talk about labor,” says Grant. “The warm bodies aspect, and how do we get more of them into our industry?”

Manufacturers can also add efficiency into this part of the process for builders. “What we've seen for a number of years — again, pre-COVID — are companies developing product features, enhancing things so that it's a quicker install. It lasts longer, fewer callbacks. I only need one trade to install, instead of three, to do this install.”

Grant explains that we need to stay top-of-mind to customers for the long-term by thinking more long-term. “I'm just worried manufacturers are just so stuck in the now. We know manufacturers just like Ford who are cutting lines, cutting SKUs simply so they can focus on their core,” says Grant.

“But what happens in two years when there is everything on the shelf and prices are still high?” Grant asks. “Have you reintroduced your entry-level price point, or did you just neglect it for the next two years?”

There are tons of ways to innovate and even more opportunities for manufacturers to win big by thinking ahead this way.

Want Even More Insight?

The challenges of inflation and supply chain issues have been overwhelming for all of us in the industry, but these obstacles shouldn’t keep businesses and professionals from moving forward.

“It's very easy to get caught up in the now … but we really can't miss the opportunity to start to build our business for that next run, whatever happens next," explains Zach.

You can check out more insights and data on building materials from The Farnsworth Group’s website, where you’ll find a monthly home improvement tracker, industry resources and updates.

You can also get access to the Building Products Customer Guide that Venveo and The Farnsworth Group put together here. If you’re looking for more information on what pros want in 2022, click here.

Be sure to listen to the full episode and subscribe to our podcast wherever you listen.