More About This Show

The Smarter Building Materials Marketing podcast helps industry professionals find better ways to grow leads, sales and outperform the competition. It’s designed to give insight on how to create a results-driven digital marketing strategy for building materials companies of any size.

In this episode, Zach and Beth talk to Todd Tomalak, Senior Vice President at John Burns Real Estate Consulting, about why he’s optimistic for the future of home construction, the one thing he wishes home builders would do more of, and why the next big construction hot spot may not be where you think.

Expected Short, Medium, and Long Term Trends in Real Estate

If you’re looking for insight into residential construction market trends, John Burns Real Estate Consulting offers invaluable information.

Beth says, “I'm really excited to have you here because John Burns Real Estate Consulting people are my favorite follows on LinkedIn by far.”

She’s not alone. Many people and companies rely on John Burns Real Estate Consulting’s information as they set plans for growth. And the reputation is earned. An 80-person firm, 100% of their business is entirely focused on residential real estate research.

The good news is, Todd’s outlook for the future is generally positive. “I’d say positive near-term, cautious medium-term, encouraged long term.”

The next six months are expected to bring in strong orders in building products, both for new build, repair and remodeling. The firm is foreseeing a potential recession in 2021 or 2022, but Todd anticipates improvement fairly quickly afterward.

Don’t Go All-In on Smart Homes … Yet

Next, Beth and Zach have some particular details about home construction and emerging trends they want to dive into.

Beth says, “I read an article recently about some of the larger home builders starting to integrate things like Alexa and Google Home into their new construction build. My question for you, from a research standpoint, do you see that type of technology integration as gimmicky or is it in response to actual demand?”

“I think the future absolutely has to go that way, but we don't have it figured out yet.”

Todd’s outlook is mixed. “I think the future absolutely has to go that way, but we don't have it figured out yet.” While there’s an appetite across many demographics for smart technologies, particularly related to security, manufacturers and suppliers haven’t fully figured out the ideal form and function.

“A hundred years ago, you saw all of these inventors trying to come up with aircraft design and some planes had like eight wings and there was no agreement on what even the shape and design of an airplane should look like. That's where we're at.”

So while the adoption of smart technology is on its way, the market isn’t there yet. “What we see today will not be what that is,” says Todd.

Zach says, “We haven't gone through that consolidation yet to say this is the standardized way of doing things.” Demand and adoption of smart home technology is expected to increase, but standardized product offerings are still yet to come.

Residential Development is Trending to Smaller Homes and Denser Neighborhoods

Zach wants to know about other trends in home construction that manufacturers should be planning for. “I'm really curious to get your input on the shifts that you're seeing, from the types of homes being built and what that means for product development for manufacturers. What are things that manufacturers need to be aware of from a product development perspective?”

Todd identifies three trends that manufacturers should be aware of. “First of all, there's been a clear pivot from the move-up homes to more entry-level.” Much of that has to do with affordability as well as first-time homebuyers entering the market. Developers are moving away from homes targeted to middle-of-life buyers to those starting out.

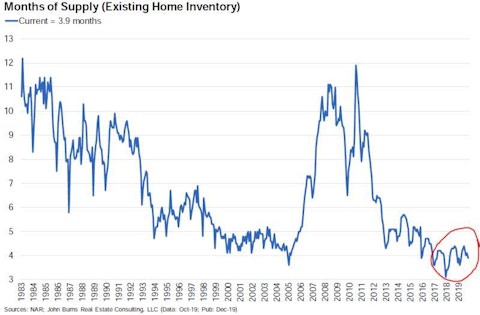

Another theme he sees is adaption to densification. “There's such a shortage of land that we're seeing densities get a lot tighter. So this means a lot more homes per acre, a little bit more creative layout of the home.”

He cites evolving designs and products like offset windows, or those installed higher to give occupants privacy even when homes are close together so that windows become more about ambient light and less about visibility.

Todd also sees some creative use of indoor space as homes get smaller, as well as increased use of outdoor spaces. “If you make those yard products that become part of regular day-to-day living space, buyers are probably willing to splurge on a little bit nicer decking, a bit nicer grill and hardscapes and things like that, even though it's the entry-level home.”

Make Products People Talk About

Zach wants to know who Todd is seeing really succeed in building products. “What manufacturer is really pacing with the shift in demands and innovating from a product standpoint?”

A few examples come to mind. “Trex has been the darling of Wall Street for the last three years for a reason,” Todd says. They report high margins on a premium composite decking product that even entry-level buyers are gravitating toward.

And Todd is impressed with their continued evolution after Trex announced a new cladding product. “I think the decking, the outdoor space, has way more players today than it did three years ago. So it's probably a smart move that they're pivoting towards cladding.”

The other product he’s seen people get really excited about is Crackle, from the Ann Sacks brand by Kohler. “It was the cull from the toilet plants, all the vitreous china basically repackaged, sold with a fantastic glaze and then put at a premium.”

But with many companies offering a recycled or other green product, what Todd sees as being noteworthy about Crackle is that it’s designed to stand out and start a conversation.

“What they did with that product was the equivalent of a Prius."

“What they did with that product was the equivalent of a Prius, meaning that it's green, it's environmentally conscious, but it's also very much a blatant social signal towards anyone who comes in the home that sees that and they go, ‘Oh, what's that? How come? What's the story there?’”

Beth sees products like this as really appealing to millennial buyers. “Millennial homeowners love when people are like, ‘What's that?’ Then you get to tell them how environmentally responsible you are. I can say that because I am a millennial and I do genuinely love that.”

Changing Demographics Means Changing Demand

With the data to back up their assertions, John Burns Real Estate Consulting isn’t afraid to contradict the media when they make generalizations about housing trends and demographics.

When Zach mentions a recent Wall Street Journal article that discussed baby boomers leaving their homes for retirement living faster than younger buyers can move into them, it turns out John Burns wasn’t impressed with what the article had to say.

“He basically blasted it and his view was that it was a pretty superficial analysis that didn't account for the influx of immigration,” Todd says.

“When I see discussion about areas dying out because these boomers are going to move away, I see it as a lot of opportunity and here's why. We're in a housing market right now where the key problem is affordability. I don't think it matters where you live. That's one of the topics that's being discussed.”

Overall, he anticipates that, net, there will be more households in 2025 than there are today. And with more first-time homebuyers moving into older homes, the opportunity for increased spending on renovation and remodeling is going to be significant.

“If you take a younger first-time buyer and you don't do anything else, there's no improvement in economy, no other tailwinds, you just put a younger first-time buyer in that older home, we see almost a 35% increase in the physical number of remodeling projects.”

And while they may not choose the same high-end finishes as the previous occupants, the opportunity is there for vendors with a confident e-commerce footprint to take advantage of.

People Are Moving, But They’re Staying Longer

While the outlook for builders and manufacturers is positive, households today are staying longer in their homes but still want access to all the amenities. This leads to the development of so-called “surban” communities, where homes farther out from metropolitan areas are built around urban conveniences, with features like walkability kept in mind throughout the community’s design.

These surban developments were intended to appeal to millennial homebuyers, for whom access to conveniences is seen as a priority. But planning and reality don’t always intersect.

Todd says, “And then the nicest units are gobbled up by new retirees. But that tells me those types of communities had a lot more broad appeal than originally we might've thought. Maybe we would have written them off to just one demographic, but it may not just be an age thing, it might be more of a societal thing.”

“10 years ago, the average person moved every 7 years and now it's every 13."

And once people move into their new homes, they stay longer than before. Zach says, “10 years ago, the average person moved every 7 years and now it's every 13 or something like that.”

So while demand created by moving households may be down, this longevity presents big opportunity in terms of remodeling projects.

Todd says, “There's going to be different choices on the type of products put in. I would even make the case that this whole shift to composite products might not have been as strong if people were moving more frequently.”

The Next Up-and-Coming Real Estate Market Is…

Zach asks if Todd would mind sharing some insight about where some of the most surprising secondary and tertiary real estate markets might be, and Todd’s answer truly is surprising.

“There is definite acceleration in secondary and tertiary markets. These are markets with positive migration — there's job growth. They're also affordable and they probably don't have as much regulation that makes it difficult to quickly develop land into new housing units, which has always been the challenge in California. So an example would be Boise.”

Boise is probably an unexpected answer for many listeners, but it’s hard to argue with the data. Not only does John Burns Real Estate Consulting survey respondents at the local municipal level, but they also look at secondary supporting data, like how often U-Haul trucks are rented for one-way trips from one city to another or even out of state.

“And so what we're seeing in the data is basically out-migration from a lot of the very expensive markets like San Francisco, San Jose, Orange County. The U-Haul data shows that all these trucks are basically leaving but not coming back. And so we cross-reference that with every possible city that we track. Boise is just off the charts.”

But why Boise?

“You go visit these areas and they're a fantastic place to live. I would totally understand why. This is the definition of surban, right? You get this beautiful, fantastic life experience, but you don't have to pay the same as you would in any of the other major Metro areas.”

Why Manufacturers Shouldn’t Only Focus on Big Projects

Zach asks Todd to close with a few more words of wisdom. “What advice would you give any manufacturer listening, and more specifically what advice do you try to give manufacturers that they don't listen to you about, that they really do need to listen to you?”

Todd says, “First of all, we spent a lot of time and energy trying to measure remodeling. And early on, we found that it was really important to break apart large, tear-out projects where you're moving walls around and spending a whole lot of money versus smaller update projects where maybe you're not tearing out, but you are updating and improving.”

He likens these smaller projects to redecoration projects but with the addition of a few fixtures, and acknowledges they may not seem very lucrative in terms of how manufacturers spend their product development and marketing dollars.

“There is a bias in building product companies believing that all of the projects are big projects."

“There is a bias in building product companies believing that all of the projects are big projects. The narrative is that someone moved into their home and they're doing the whole kitchen or they're doing the whole exterior.”

In fact, he says, this isn’t the case.

“What we're seeing is a large part of their business is actually being driven by these much smaller updates. I would spend a whole lot more time thinking about, rather than a $40,000 bathroom remodel, what is this household is going to do for $5,000? Because that's the part of the market that we believe is going to grow the fastest over the next few years.”

Got a Question?

Get in touch with Todd on LinkedIn or by email, and find out more about John Burns Real Estate Consulting on their website.

If you have questions about how to drive sales in today’s shifting real estate market, let us know! Shoot us an email at [email protected] with all of your questions.