Residential builders' expectations of building product manufacturers have changed significantly over the last 12 months. What has worked in the past to target them and win new business isn’t enough anymore. If you’re not looking at your sales and marketing strategies to see how you can meet these shifts, you could be losing business.

Venveo and The Farnsworth Group surveyed 101 residential builders from across the United States about how their purchasing behaviors have evolved over the past year. All of the builders involved in the study have direct decision-making or influence on building products purchased for their projects.

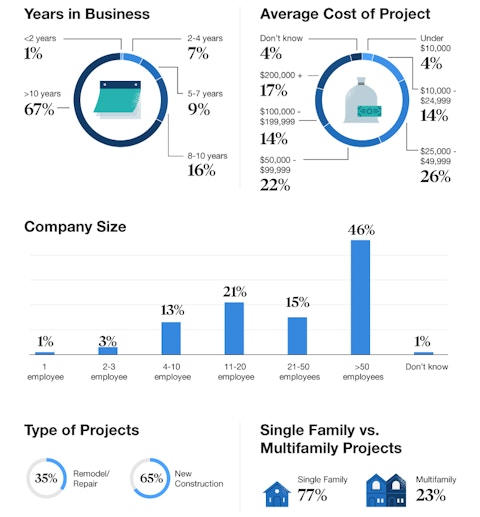

Demographics of the Home Builders Surveyed

Builders are experts at their craft and most have been in the industry for 8 or more years. They have more than 50 employees and spend upwards of $200,000 on projects.

It’s not just the tech-savvy younger generation that are seeking out new brands and researching products online. Lack of availability and changes in technology have forced builders to use digital channels for trying products from new businesses.

Purchase Channels Residential Builders Use

Before the pandemic, 67% of builders were primarily purchasing materials from dealers and lumberyards and visiting them. Today, 43% of builders purchase online for delivery or store pickup. We’ve seen a gradual shift in the building materials industry adopting a digital focus and the pandemic has fast-tracked that. Building product manufacturers must be able to provide valuable online shopping experiences and information to accommodate builders’ needs.

Here’s what our study found in regards to how builders’ purchasing habits have changed after the pandemic:

Home builders are shopping more online than ever before, and that’s not going to change. 80% of respondents indicated they expect building and home improvement suppliers to make online ordering an option for them going forward.

Manufacturers need to invest in a professional website and eCommerce capabilities to make it easy for builders to purchase products, increase their loyalty and earn new business. Manufacturers who don’t invest in a streamlined web presence or user-friendly eCommerce platform will find themselves starting to fall behind the competition as builders move to companies that provide everything they need in one, easy-to-use place.

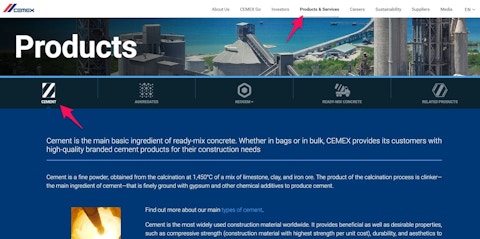

Look how effortless it is to find products and services on the Cemex website.

You can easily navigate to each type of product, get more information and contact them if you need help placing an order.

How Purchase Behaviour of Home Builders Have Changed

Availability was one of the biggest driving factors behind why builders chose a new brand. 71% reported that they tried a new retailer for the first time during the pandemic because that retailer had what they needed in stock.

We understand that inventory and supply chain demands were — and still are — very challenging. Don’t expect this challenge to resolve itself quickly. However, you can ensure your builders stay loyal through better communication and transparency in your marketing.

For instance, Menards displays how many people have recently purchased a product, minimum order requirements or if it’s out of inventory.

Let customers know when products will be back in stock and shipped. Offer value-driven content and experiences that educate them, build trust and make them better at their craft. By being helpful and transparent in your communication efforts, your brand will be one of their first considerations when they need to purchase building materials products for new projects.

Brand Selection & Expectations

How are builders selecting new brands? Our report discovered that 36% of builders used a building product or home improvement brand for the first time during the pandemic and that the new brand was often better quality.

When asked why they selected a different brand, 52% of builders indicated that their preferred brand was out of stock and new brands were readily available. And of those who select a different brand, 24% of respondents said the new brand was much better than their normal choice and 49% said it was somewhat better.

Because availability is one of builders’ driving factors when purchasing AND because of supply shortages, it’s no surprise that they are trying new brands. If you want your brand to be the new brand of choice, it’s essential that you are active on the different channels that builders are currently using to research and buy.

Today, builders are using a mix of social media, websites and ads to discover new-to-them building materials manufacturers.

How Home Builders Are Discovering Building Products Brands

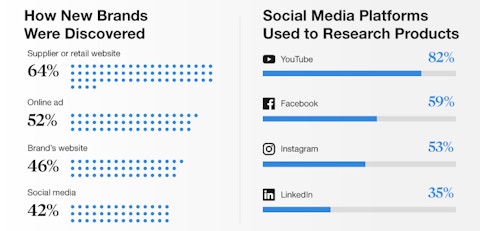

Having a digital presence has always been important. But now? It’s more crucial than never. 64% of the time, builders discovered new brands through supplier or retail websites, while 52% of brand discovery was achieved through online ads and 46% through brand’s websites.

Building materials manufacturers can invest in ads on platforms like Google Ads, Facebook, Instagram and LinkedIn. These will help you reach more prospects, communicate the value of products and drive traffic back to key assets like your website.

Building pros also leverage social media to research products and learn about brands. 82% indicated that they use YouTube, and 59% indicated that they used Facebook to research products. This was followed by Instagram at 53% and LinkedIn at 35%.

In order to get the most out of your social media accounts, ensure that you are active across your chosen networks to drive traffic back to your website, generate leads and build authority. Display your products, publish helpful content and engage with followers on a regular basis to grow your account and get more eyes on your accounts.

Final Thoughts on Home Builder Audience Insights

Selling to builders and driving the most growth for your building materials business begins with understanding your customers’ behavior. Where do they shop? What are they looking for in brands? Being able to solve their pain points and provide convenient shopping experiences in the places online where builders go will help you win more business. You’ll also be more prepared and aligned with trends when the pandemic ends versus competitors.

Our report with The Farnsworth Group discovered that fewer builders are shopping at physical retailers. They’re purchasing products online for delivery or pickup. Your company must provide online platforms for purchasing build materials to keep up with this demand. Use social media, your company website and online advertising to generate leads and awareness.

28% also reported that they tried a new retailer for the first time during the pandemic. 71% said they tried the new vendor because they had what they needed in stock. Builders are searching for products and choosing based on convenience and availability. Be transparent about inventory and use other mediums like content and design inspiration to provide value.

For more data and insight on builder purchase behaviors, get the full report here.

If you want to know where to start when it comes to How to Market to Builders, check out this in-depth article for best practices and proven strategies.